News

Fed will protect the U.S. economy before the crisis

This is the second time in less than a week, "boss" the U.S. central bank voiced reassure the public about the likely impact of the severe European debt crisis for momentum unstable recovery of the U.S. economy.

This is the second time in less than a week, "boss" the U.S. central bank voiced reassure the public about the likely impact of the severe European debt crisis for momentum unstable recovery of the U.S. economy.

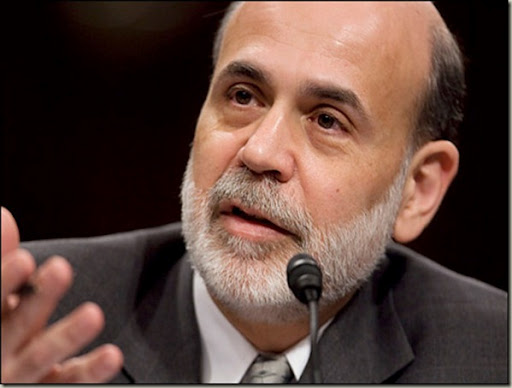

Fed Chairman Ben Bernanke. (Source: Internet)

Bernanke's speech in a hearing before the Senate Budget Committee acknowledged that although the U.S. has appeared a number of positive factors such as the job market is brighter and the unemployment rate for the month 1/2012 reduction to 8.3% - its lowest level in three years, but the recovery of the U.S. economy remains sluggish.

The statement above is not so optimistic, the economists predict the Fed will not change in the policy interest rate to maintain basic level almost equal to 0 in order to promote economic recovery.

In view of the Fed, to maintain ultra-low interest rates (0-0.25%) for overnight loans between banks at least until the end of 2014 will have the effect of encouraging consumers and businesses U.S. business borrowing to increase spending and investment, thereby contributing to economic development.

Mr. Bernanke also said the Fed left open all options, which do not exclude the possibility of the end of 2012 to launch a new round of bailout money to buy any more bonds to protect the U.S. economy from the party before the risk outside, including the negative impact from the European debt crisis as well as the relationship and tension between Iran West.

Last week, during a hearing at the House of Representatives, Mr. Bernanke is determined to defend its ultra-low interest rate policy applied since 12/2008 despite criticism from some Republican lawmakers that maintaining the term low interest rate risk and inflation increases recurrence of "bubble" in the real estate sector was the cause of the financial crisis, the most serious in the U.S. in 2007-2008 for over 60 years.

Mr Bernanke stressed the Fed has been closely monitoring, maintaining regular contact with the European partners, while also preparing plans to protect the general economy and financial system Americans in particular, before the impact of the European debt crisis. /.

(TTXVN/Vietnam+)